Online Pan Card Form Free Download

The PAN number does not change during the lifespan of the PAN holder. E PAN Card Download / Reprint PAN Card. In case of your pan card gets lost, stolen, misplaced, damaged or information printed on your current pan card is incorrect then you must need to apply for a duplicate pan card or download copy of pan card online.

PAN card plays a vital role in purposes like filing of income tax, transaction of huge amounts and also it is a useful identity proof. Serving such serious purposes with PAN card clearly reflects the importance of its correctness. If the PAN card is not correct, with genuine information, the sufferer will be the cardholder.

Unfortunately, mistakes are obvious by human beings and for that many incorrect or misspelled information get fed unintentionally while applying for a PAN card.

Worry not! Now, correcting PAN Card information like Name, Address, etc. has become just a few clicks affair.

New Pan Card Application Form Free Download Pdf 2015

- Free Pan Card Application Form - PDF Form Download. Overall rating: ☆☆☆☆☆ 0 based on 0 reviews. To apply for a Pan Card. Content and Description including but not limited to form descriptions, page content, page titles are all properties of Form Download and its Authors.

- After filling this Pan card application form, download, print, sign and send all related documents to complete the steps needed to apply for a new pan card. Application Form for New PAN Card - Resident Indian Citizen.

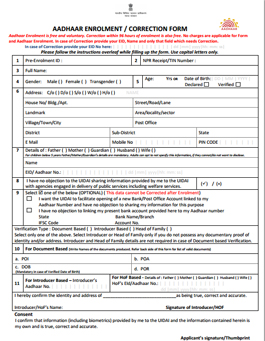

Online PAN Card Correction Form Download

PDF Form >>https://www.tin-nsdl.com/downloads/pan/download/Request-for-New-PAN-Card-or-and-Changes-or-Correction-in-PAN-Data-Form.pdf

Steps to Correct Name, Address Online

- Browse the link https://www.tin-nsdl.com/services/pan/pan-index.html

- Scroll down a little, then under “Change/Correction in PAN Data” section click on “Apply”.

- Under “Apply Type” dropdown, select “Changes or Correction in existing PAN data / Reprint of PAN Card (No changes in existing PAN Data)“ and fill up the whole form this time with the correct name, address, and all other information.

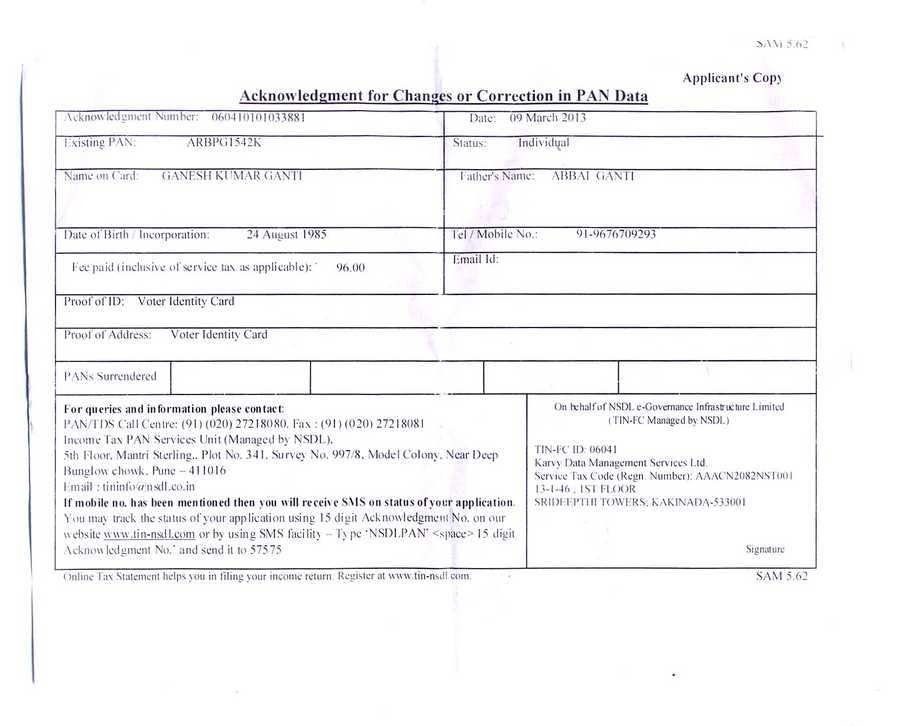

- Please, reconfirm before submitting the form, after which you will receive a 15-digit acknowledgement number.

- This 15-digit acknowledgement number will be in use to track the status of your application.

- Finally pay the service charges through net banking, debit/credit card and take a print out of the form.

- To go for online submission, scan the required self-attested documents and upload them.

- If you don’t have scanned documents or any source to scan, then take a print out of the form after submission and end the hardcopy along with all required documents by mail to:

Income Tax PAN Services Unit (Managed by NSDL e-Governance Infrastructure Limited)

5th Floor, Mantri Sterling, Plot No. 341

Survey No. 997/8, Model Colony

Near Deep Bungalow Chowk

Pune – 411 016